|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

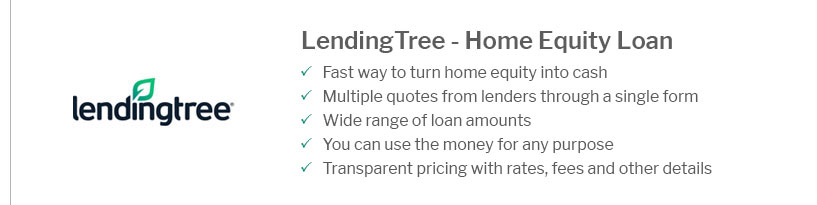

Best Company to Refinance a House: A Comprehensive GuideRefinancing your home can be a strategic financial move, but choosing the best company to refinance a house is crucial to maximize benefits. This guide explores top contenders, factors to consider, and how refinancing can be advantageous. Why Consider Refinancing?Refinancing a home involves replacing your existing mortgage with a new one, typically to lower interest rates or change loan terms. It's an effective way to reduce monthly payments or even take equity out of your home. Key Benefits

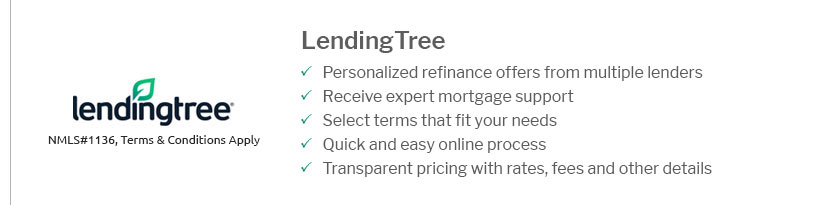

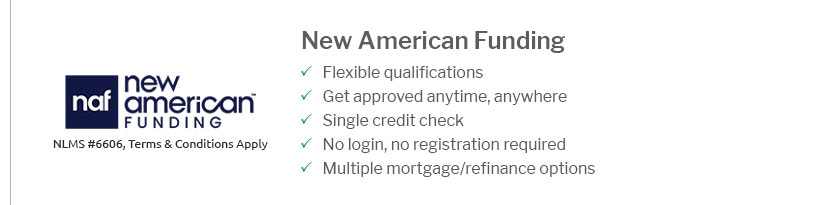

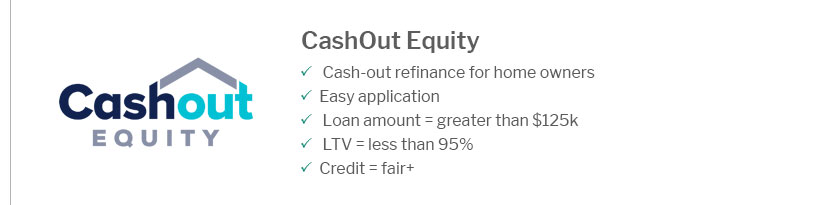

For those looking to understand more about how to refinance take equity out, there are specific lenders who specialize in this process. Top Companies for RefinancingIdentifying the best company involves considering rates, customer service, and the application process. Here are some highly regarded options: Company AKnown for competitive rates and excellent customer service, Company A offers a streamlined online application process. Company BCompany B provides flexible refinancing options and is highly rated for its educational resources for borrowers. Company CWith a focus on personalized service, Company C stands out for its tailored loan options and professional advice. Factors to ConsiderWhen choosing a refinancing company, consider the following:

Understanding the refinance settlement process is essential, as it can impact the overall timeline and costs. FAQWhat are the benefits of refinancing a house?Refinancing can lower your monthly payments, reduce interest rates, and provide access to home equity for cash if needed. How do I choose the best refinancing company?Consider interest rates, fees, customer service, and reviews. Evaluate how each aligns with your financial goals. Are there any risks involved in refinancing?While refinancing can offer savings, risks include extending the loan term and potential fees, which may outweigh benefits if not carefully considered. In conclusion, refinancing your home is a significant decision that requires careful consideration of various factors. By choosing the best company to refinance a house, you can ensure a smooth process and optimize the financial benefits. https://www.investopedia.com/mortgage/refinance/how-pick-right-lender/

Since loan officers and mortgage brokers often earn money from their transactions with you, it's important to research to ensure you get the best deal. Mortgage ... https://www.navyfederal.org/loans-cards/mortgage/refinancing.html

Explore and compare today's mortgage refinancing rates to learn if there's a better loan option for you and your home. https://money.usnews.com/loans/mortgages/mortgage-refinance-lenders

Best Mortgage Lenders for Refinancing - Lenders in More Detail - Rocket Mortgage - PenFed Credit Union - New American Funding - Farmers Bank of Kansas City - NBKC ...

|

|---|